Payday Lending

In the summer of 2016, the Consumer Financial Protection Bureau (CFPB) proposed a national rule on payday lending. The Maryland Consumer Rights Coalition joined with other advocates in PaydayFreeLandia (states where payday is outlawed) to fight for stronger consumer protections in the rule.

What is a Payday Loan?

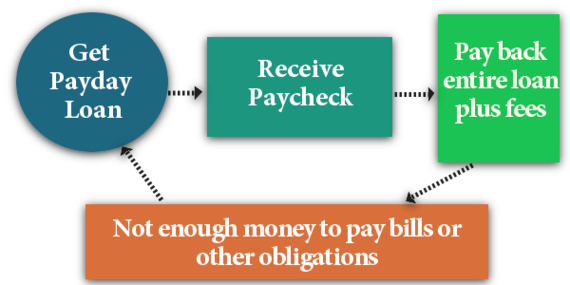

Payday loans are short-term, high-interest loans. Payday lenders provide cash-strapped consumers with small, short-term loans that must be paid back by the next payday. These firms can charge interest rates ranging from 300% to 1000%, making it impossible for most consumers to pay back the original loan plus the interest rate. This forces borrowers to roll the first payday loan into a second, leading to a debt trap that is hard to escape.

History of Payday Lending in Maryland

Maryland has steered clear of these predatory loans for more than 40 years. In Maryland, our interest rate cap of 33% keeps payday lenders from opening stores in our state and protects consumers from this debt trap.

Yet, according to a study from Pew Charitable Trusts, at least 3 percent of Marylanders take out a payday loan from an online payday company-despite the fact that these businesses are unlicensed in the state. These online lenders are charging Maryland families interest rates ranging from 120-1,200 percent. More than 150 complaints have been filed in the last two years with the Commissioner of Financial Regulations’ office.

Although the new CFPB rule is great for states that currently allow predatory lending, the policy needs to be strengthened for payday-free states or it could pave the way for payday lenders to return, open up shops, and trap thousands of low-income families in unsustainable and unaffordable loans.

What Are We Doing About It?

From the time the CFPB's rule was proposed to the end of the open commenting period, MCRC staff worked to generate comments from Maryland residents, organizations, faith leaders, and others. When the CFPB closed its commenting portal, MCRC had gathered approximately 450 letters, online comments, postcards, and photo petitions from Marylanders, asking the Bureau to strengthen the rule to protect consumers in our state and beyond.

(Members of the MCRC staff posing with Paul, our predatory loan "shark.")

We concluded the commenting period by joining other PaydayFreeLandia advocates to hand deliver some of our photo petitions to Director Richard Cordray, head of the CFPB.

(Staff members, Jen Diamond and Paul the Shark, delivering our photo petitions to Director Cordray.)

You can read our 2019 comment to the CFPB, expressing the need for Marylanders to be protected from payday loans by clicking here. If you are an organization, you can download and use this template to send your own comment letter by May 15th.