ACTION ALERT: Tell Your Electeds to Make Auto Insurance Fair & Affordable

This week, the Senate Finance and House Economic Matters committees heard two critical bills that will make auto insurance more fundamentally fair and more affordable. SB 533/HB 1295 and SB 534/HB 916 were sponsored by Senator Joanne Benson in the Senate, and Delegates Ben Brooks and Charles Sydnor in the House. Both bills provide critical pathways towards more fair and affordable insurance.

Act now and tell your state Senator and Delegates to pass these bills to create a more fair and affordable auto insurance system in Maryland.

The Issue:

Affordability. Maryland law requires that all drivers carry at least limited liability car insurance. Auto insurance in Maryland is extremely expensive, which means the cost of purchasing and maintaining costly premiums is a financial strain on low-and-moderate income families.

Maryland’s average insurance premiums of $1,103 a year are the ninth highest in the nation.

The high cost of auto insurance is one important reason why 15% of drivers in Maryland remain uninsured.

Fundamental Fairness. In addition, current law allows insurance companies to use a number of non-driving related factors to price each premium. Some of these factors include credit score, zip code, occupation, education, sex, and marital status. The use of these non-driving related factors drive up the cost of insurance and discriminate against women and low-income drivers in struggling communities and communities of color.

Why is Car Insurance So Costly?

In 2010, the General Assembly raised the minimum liability required for auto insurance from $20,000/$40,000 to $30,000/$60,000. Only four states have higher minimum liabilities. Maryland rightfully requires drivers to be insured, but we also need to make sure that they can afford the insurance that they are required to have.

Auto insurance companies can use driving and non-driving related factors to “assist insurers in predicting the likelihood that you will be in an auto accident in the future or will file a claim for damages.” (MIA Consumer Guide). The use of non-driving related factors means that lower-income drivers will subsidize wealthier ones. It also means that someone with a perfect driving record but poor credit will pay more than someone with two at-fault accidents but perfect credit.

Why Should I Care?

Affordability. The high costs of basic coverage means that many workforce development and low-income workers pay 12-17% of their disposable income on car insurance (read more HERE). The Federal Insurance Office’s study on auto insurance affordability assessed the cost of auto insurance in underserved communities throughout the nation. FIO found that over 330,000 people live in zip codes in Maryland where auto insurance is currently unaffordable.

Fundamental Fairness. MCRC’s 2017 study found that women are charged as much as 39% more than men for a basic car insurance policy, and that women who are single are penalized with a24% increase in cost based on their marital status, while men who are single frequently receive a discount (read our new report).

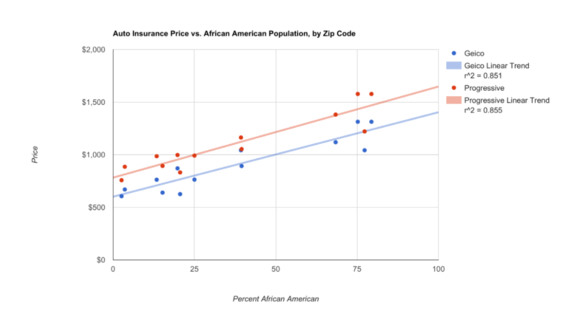

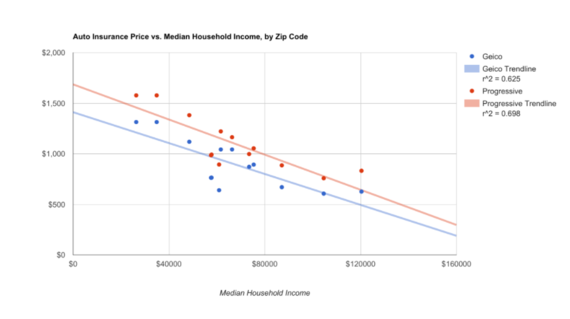

MCRC’s 2017 statistical analysis has found the more African-Americans that live in a zip code, the higher the cost of insurance (at a statistically significant level). The analysis also found that the wealthier the neighborhood, the less the residents of the neighborhood would pay in insurance (statistically significant).

Read more all about these issues here.

What SB 533/HB 1295 and SB 534/HB 916 will do:

SB 533/HB 1295 will create a low-income auto insurance program. The program will allow auto insurance firms to offer a basic policy at lower limited liability limits which will reduce the cost of insurance.

SB 534/HB 916, as amended, will eliminate marital status and the "widows' tax" from being used to price auto insurance so that being single or losing your spouse will not drive up your insurance rates.

Can you take a few minutes today to call or email your Delegates and Senator? CLICK HERE for information on how!

Thank you for your support!